Take the hassle out of 1099 filing

Xero helps you prepare 1099s for e-filing. View and customize reports, then file 1099s online using a connected app.

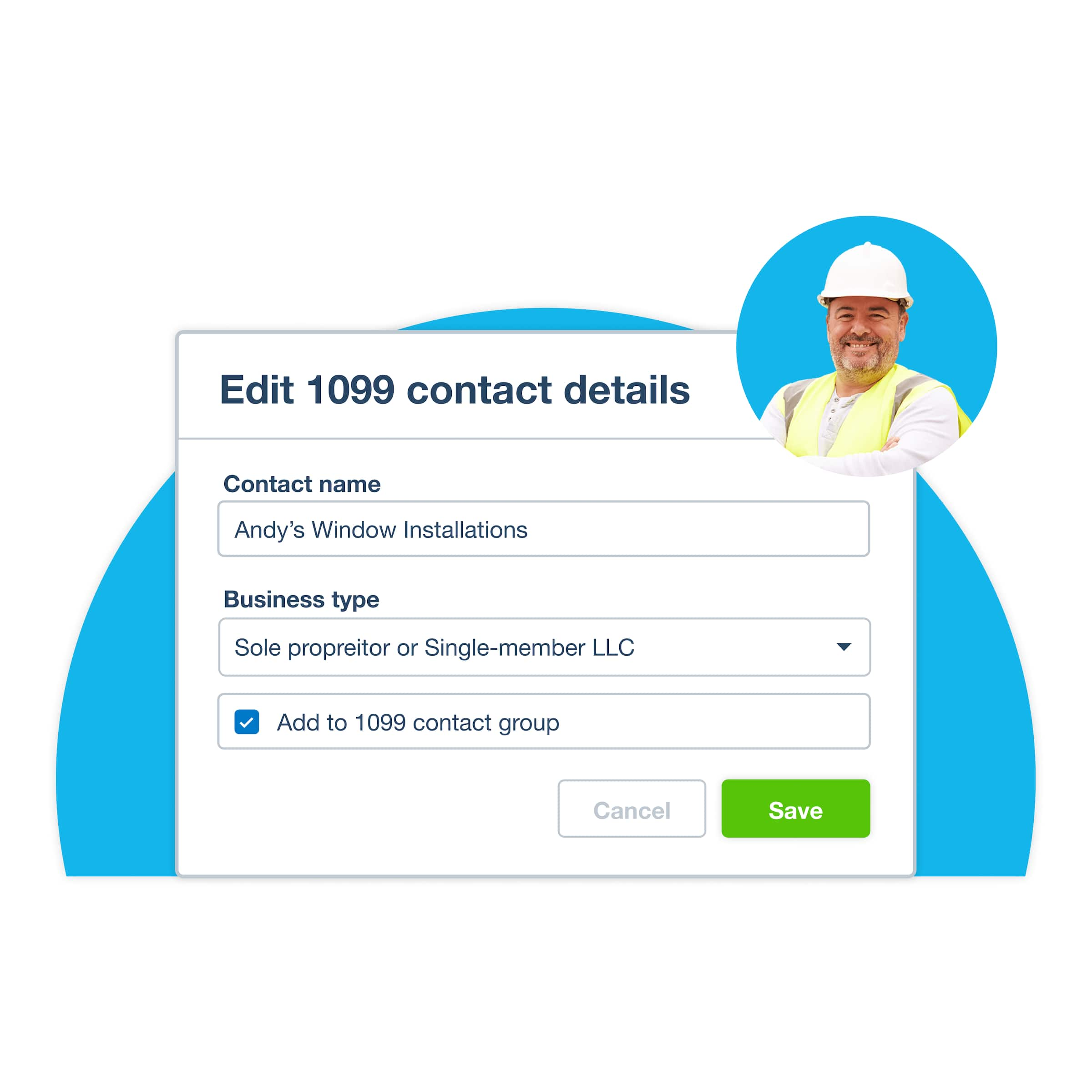

Manage your 1099 contacts in one place

Manage your 1099 contacts in one place, and update contact details including business type. Easily add contacts to the 1099 default contact group with the tick of a box.

Prepare 1099 reports

Create, view and manage 1099 reports. Set up rules to report payments on 1099-NEC and 1099-MISC forms. View transactions that match your rules, and see a summary of contacts and payments in reports.

Review and fine tune reports

Edit contractor details from the 1099 report and review their transactions. You’ll know about missing contact details before filing. Transactions below the $600 payment threshold are excluded.*

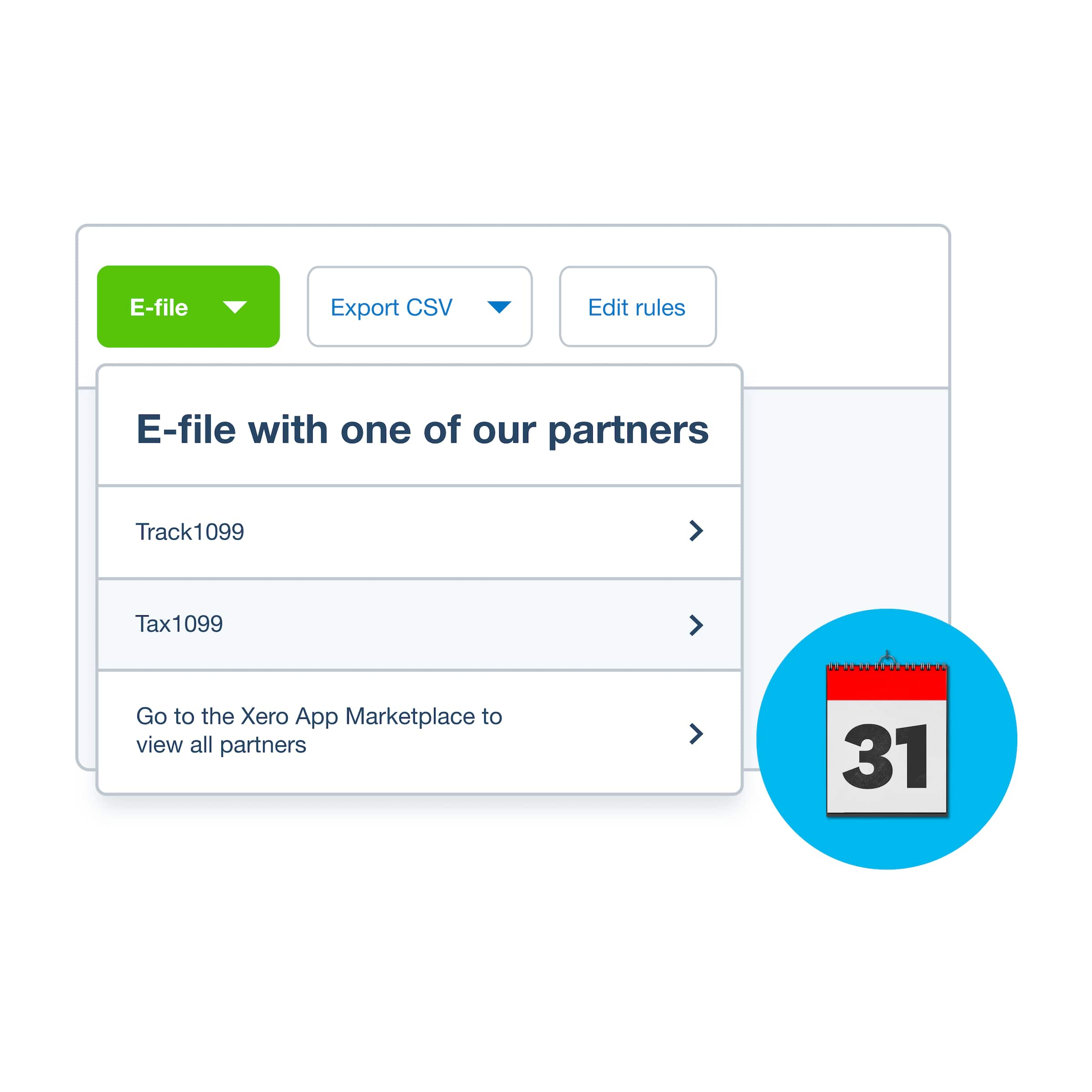

File and complete 1099 forms

Use the friendly due-date reminders so forms are filed before IRS deadlines. File 1099s through one of the e-filing apps that connects to Xero, or export your reports as CSV files.

More about filing 1099s

Xero excludes transactions under the $600 payment threshold and credit card transactions. You can also remove other transactions such as debit card or third-party payments. You can still see excluded transactions in the 1099 report.

A 1099-NEC is an IRS form for reporting income payments made to non-employees such as independent contractors who’ve provided a service during the tax year. Find out more in the Xero guide to 1099-NECs.

Learn more about the 1099-NEC formBefore 2020, payments to contractors were reported on the 1099-MISC. You may still need to file a 1099-MISC if you need to report miscellaneous income such as rent or royalties. The 1099 report in Xero has a section for 1099-MISC and one for 1099-NEC.

Learn more about 1099 in XeroTo pay 1099 contractor expenses, create a bill or a spend money transaction, or submit a company expense claim as normal. Xero includes expenses paid via the Xero expenses feature in 1099 reports not to classic expense claims.

See how to pay 1099 contractor expenses

Start using Xero for free

Access all Xero features for 30 days, then decide which plan best suits your business.

- Safe and secure

- Cancel any time

- 24/7 online support