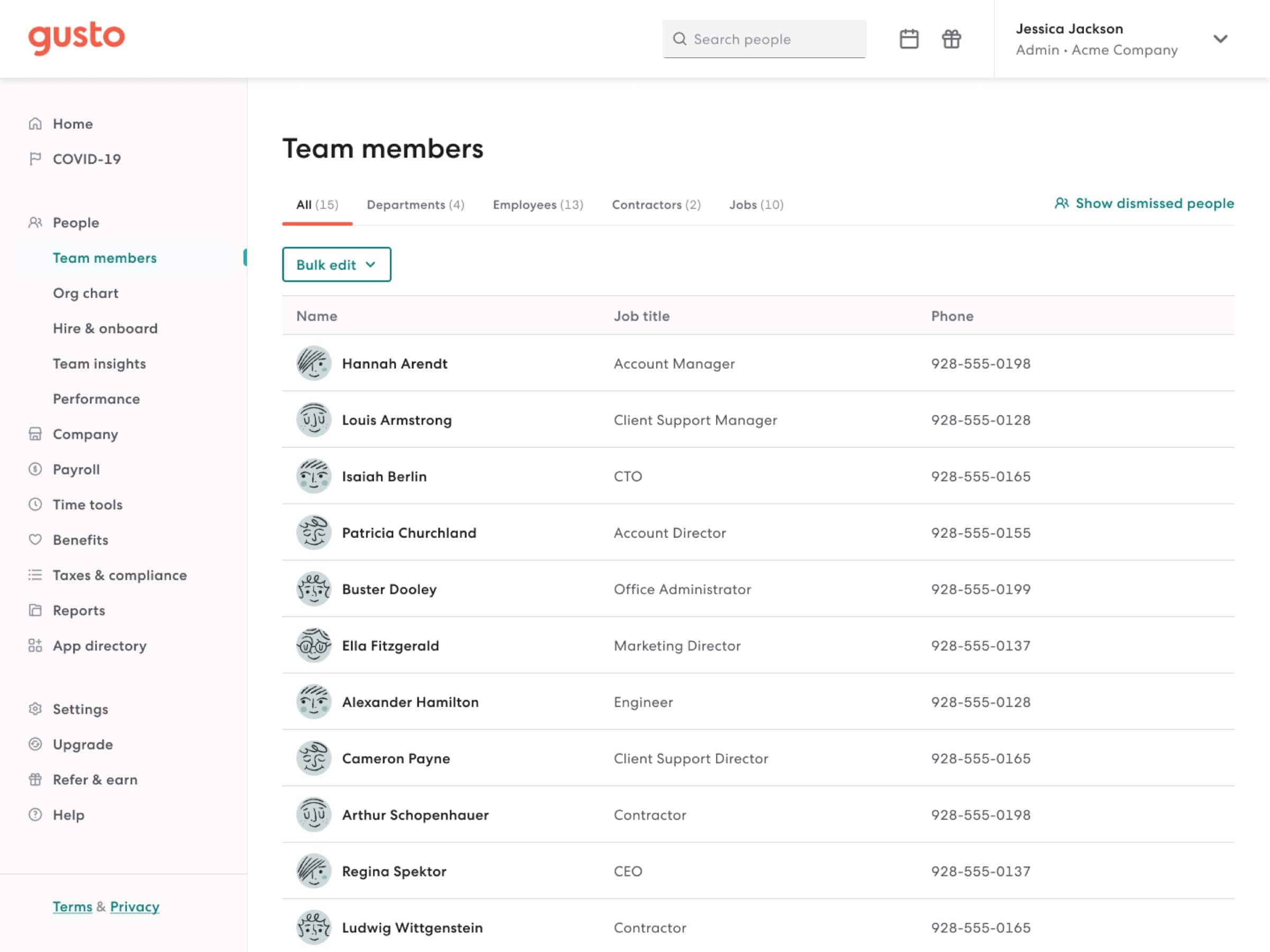

Use Gusto payroll software and Xero

Use Gusto payroll software to calculate pay and deductions, pay employees, and update the Xero accounts.

Flexible payroll filing

Gusto provides online payroll for all 50 states.

Automated payroll

Automate payroll taxes, deductions and filings.

Employee self-service

View paystubs and W-2s online.

Flexible payroll filing

Use Gusto, Xero’s preferred payroll partner, integrated with Xero accounting to run and manage your payroll online.

- Manage federal and local taxes, filings and tax payments

- Automated payroll filings, W-2s, 1099s, and direct deposit payments

- Comprehensive payroll and next-day direct deposit

Automated payroll

Pay employees with ease with local, state and federal payroll taxes automatically calculated, filed and paid.

- Payroll runs itself if you choose with Payroll on Autopilot®

- Send automated payday emails to employees from payroll software

- Set up multiple schedules and pay rates

Employee self-service

Give your employees online access to their pay details.

- Employees can set up their own accounts using payroll online

- Paystubs and W-2s are stored online for easy reference

- Payday notifications arrive in their email

More about payroll with Gusto

Users of Xero and Gusto benefit from their deep integration. Your Xero sign-on gets you into Gusto as well. See and reconcile your Gusto payroll transactions in Xero, and easily jump into Gusto from the Gusto payroll menu tab in Xero.

See how to set up Gusto payroll for your Xero businessFirst, connect Xero with Gusto and map your chart of accounts. Then total wages, taxes, benefit deductions/contributions, reimbursements and contractor payments sync to your Xero account each time you run payroll online.

See how to set up the Gusto to Xero integrationAdd 1099 contractors as contacts, then set up rules so expenses are automatically recorded on 1099 forms. File 1099 forms with the IRS using Track1099, Tax1099 or a service like PayPal. If you submit a paper form, export the 1099 in CSV format.

See how to set up and pay 1099 contractor expenses

Start using Payroll for free

Access all Xero features for 30 days, then decide which plan best suits your business.

- Safe and secure

- Cancel any time

- 24/7 online support

I’ve gone from zero control to Xero control

Made by the Forge use Xero to make quick decisions